How Companies Can Create Trust and Help Workers Build Financial Stability

By Ennie Lim, HoneyBee co-founder and CEO

Imagine it’s a weekday morning. You have your coffee and you’re all ready to go to work, but your car won’t start. The tow truck takes your car to the mechanic who quotes you $600 for the work you need.

Today, 63% of American adults (nearly two out of three) do not have $500 in savings to deal with such an emergency, according to a study from Bankrate. Despite being fully employed with a steady income, they still have no access to affordable credit and little understanding of how to manage their personal finances.

Personal Financial Struggles Are Difficult to Discuss

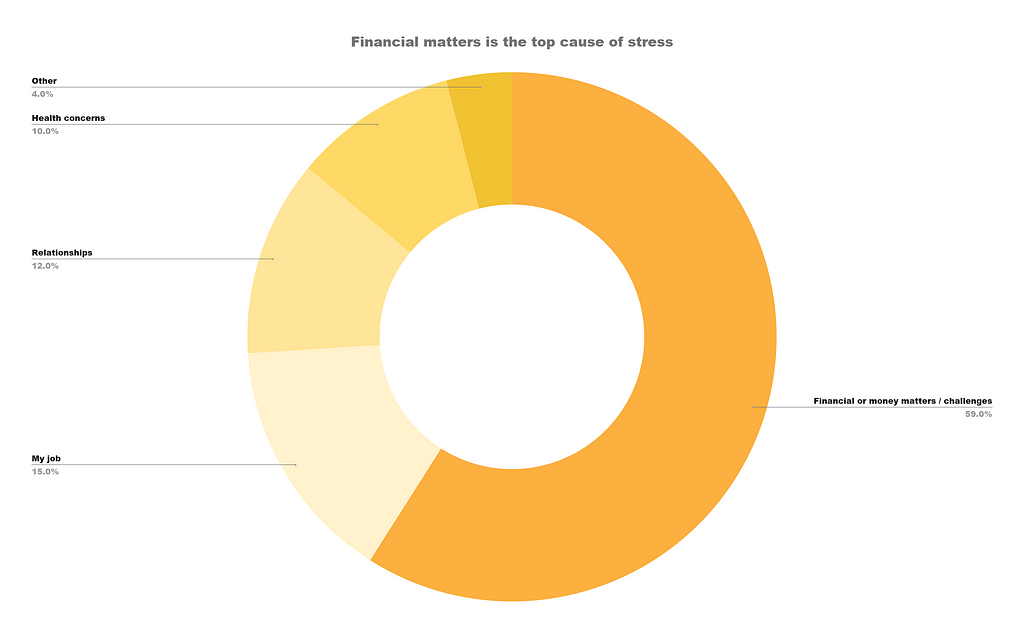

According to PwC, 59% of workers report feeling stressed about their finances. It’s no wonder. A different study by the Federal Reserve found that 41% of American adults could not cover a $400 emergency with cash, savings, or a credit card they could pay off when the statement came in. So if the car breaks down, the lease is up and they need to pay a security deposit, a long-distance relative is sick and they need to get on a plane, or they break a tooth and don’t carry dental insurance, they are stuck. And stressed. One financial crisis can disrupt their lives.

No doubt about it, that stress spills over into the workplace. The same PwC survey reports half of workers spend three hours or more thinking about, or dealing with, financial issues. As a result, these employees are more likely to take unplanned absences or experience presenteeism: They’re at their desks but their minds are elsewhere, and they struggle to meet deadlines and maintain standard levels of productivity and quality work.

It’s not just problem-solving that has these employees preoccupied: How will I get to work without a car? Or how will I afford the dentist bill? It’s shame too. They may feel embarrassed by their situation or humiliated by their need to seek help. Admitting they are struggling financially makes them feel not only socially vulnerable but financially vulnerable too.

It’s a vicious cycle. Employees fear that their financial woes will affect their ability to earn and their hope of ever climbing out of a hole. They worry that if their personal problems are revealed it could lead to rejection or, worse, termination. Employers expect their employees to be able to manage their lives, they tell themselves. This stress can affect the quality of the employee’s work, thereby triggering fear about job security, and a downward spiral begins. Compounded with this anxiety is the fact that workplace benefits are out of reach for many low- to moderate-income Americans.

HoneyBee is part of the community of Certified B Corporations. Learn more about this growing movement of people using business as a force for good, and sign up to receive the B The Change Weekly newsletter for more stories like this one, delivered straight to your inbox once a week.

Empathy Unlocks Trust

The more you understand the struggle and remain sensitive to the insecurities of those in financial hardship, the better you will be at creating a safe container where they can open up about their problems. This, in turn, will help lead you to the appropriate solution and an improved relationship with your employee.

This is a practice we put to use at HoneyBee. By the time we initiate the financial conversation, it’s already clear that we’re on their side, ready to serve them — not make a buck off them. Our business allows employees access to emergency funds whenever they need it, regardless of their credit. These no-interest, easy-to-repay loans help them attain financial stability. In addition, we provide one-on-one financial coaching to help them set new goals for themselves and plan for the future. In doing so, we’ve shown a fundamental understanding of their problem and addressed it with the very design of our holistic financial wellness program.

With employee concerns over being exploited taken off the table, the stage is set for conversations of trust. Having drawn from our empathetic insights, we anticipate their anxieties. Now, any conversation can proceed much more smoothly.

Share Your Story

A safe container needs trust, transparency, authenticity respect and emotional safety. Once a foundation of trust is established along these lines, we can engage customers in a transformational way. Stories make for a good start.

I like to start with my own. When I first moved to the U.S., I was in a tough financial spot. I was credit invisible in the U.S. banking system; I was unable to get approved for a credit card or a loan, thus unable to build my credit. My inability to access low-cost loans put me at a significant financial disadvantage.

That authentic sharing puts my own image on the line and sets the tone for the sharing to come. It signals that we’re safe — that they can let their guard down without having to worry about repercussions or being lectured. We’re putting our cards out on the table, letting them know that we’ve been there too and we’re here to help.

Take One Step Toward Financial Wellness

Organizations must take steps to help employees establish financial security or at least access financial safety nets to avoid an overburdened, underproductive and disengaged workforce. To do so, organizations should:

- Remove the stigma of discussing money. Your employees are at work for many reasons; making money is one of them. Cultivate an environment where talking about money is accepted. For employees to feel safe sharing their personal challenges, focus on creating a culture of trust, transparency, authenticity, respect and emotional safety. Start at the top. Maybe members of your management team were once credit invisible, unable to get approved for a credit card or a loan. Maybe they struggled with financial insecurity. Encourage them to share their stories so employees can learn from each other.

- Offer personal finance and credit coaching. A holistic financial wellness program should include financial education. Personal financial counseling is the gold standard. Counselors can provide insight on how to improve a credit score, manage a monthly budget, and more.

- Provide access to rainy day funds. Partner with a provider of non-predatory, no-interest emergency funds that help your employees get on the right track with their finances.

The more organizations empathize and invest in the whole person, not just the employee, the more engaged and productive the workforce will become.

With a little empathy, everyone wins.

B the Change gathers and shares the voices from within the movement of people using business as a force for good and the community of Certified B Corporations. The opinions expressed do not necessarily reflect those of the nonprofit B Lab.

Are Your Employees Struggling Financially? Start with Economic Empathy was originally published in B The Change on Medium, where people are continuing the conversation by highlighting and responding to this story.